Sometimes we are our own worst enemies, dampening our spirits and limiting our potential.⛈️

These could be fears of :

🔧Losing control

🔧Looking bad

🔧Going outside our comfort zone

🔧Not having all the answers

🔧How people will view us or think of us

🔧Impacts on our career

🔧Being powerless

🔧Not getting the validation or approval from others that we need or seek

This week we release the eleventh leadership chronicle and a story of success shared by Sonia Aslam from the 19th conversation of #globalleadershiphypothesis – what makes a great leader.

The first step to conquering fear – become aware of the fear and understand the impact.

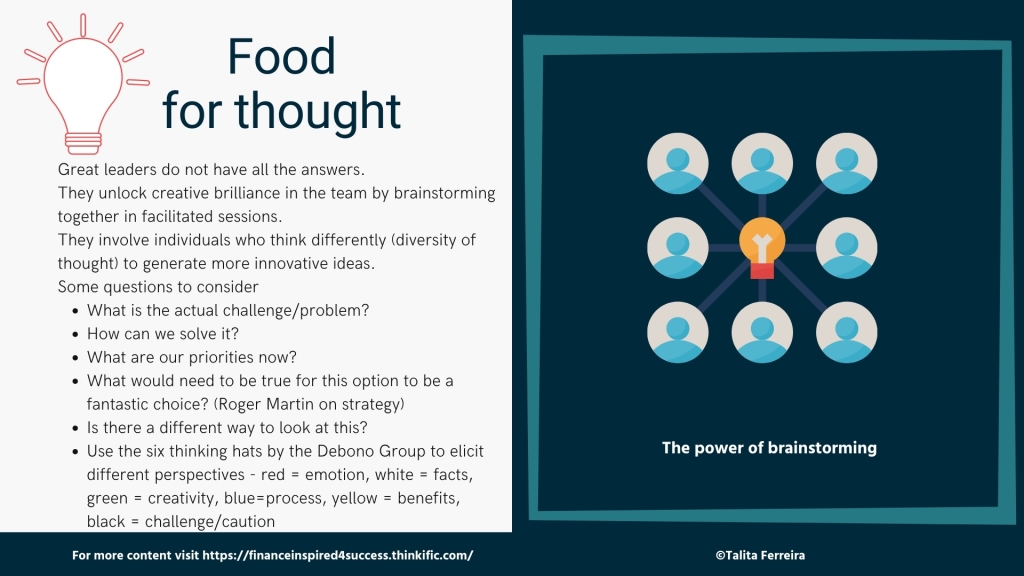

If we want to be great leaders, we need to focus on keeping a positive attitude, letting go of control and bringing out the best in our teams.

Have you encountered any other fears that hold leaders back ❓

#leadershipdevelopment #financeleaders #cfoinsights

Interested in Leadership and what makes a great leader? Visit The Global Leadership Hypothesis for a range of interviews with Chairman of Boards, finance professionals, influencers, thought leaders, leadership consultants and many more

Access the trailer interview, full interview or transcripts to accelerate your leadership – learn from others https://bit.ly/GLHYPO

© Talita Ferreira, CEO and founder of Authentic Change Solutions